Sales Market (2024–2025)

1. Sales Volume & Value

In 2024, final deeds of sale rose by 3.4%, and promise of sale agreements (PoSAs) by 3.1% compared to 2023

The total value of final deeds of sale reached approximately €3.5 billion in 2024, marking a 7% year-on-year increase

In February 2025, PoSAs saw a 7.5% increase from the same period in 2024, with 1,253 agreements registered (up from 1,166)

2. Price Trends

Q1 2025 saw the Residential Property Price Index (RPPI) hit 169.09, a 5.7% annual increase from Q1 2024, and a 1.5% rise quarter-on-quarter

Apartments: index 168.67 (+5.3% YoY)

Maisonettes: index 162.06 (+6.2% YoY)

Over the past decade (since 2015), Malta’s property prices have risen by ~53%, with peaks of +6.94% in 2021 and +7.54% in 2023

By mid-2025, growth is easing: Q2 2024 had a modest +3.38% YoY, and some quarters even dipped, reflecting a market shift toward stabilization

3. Market Drivers

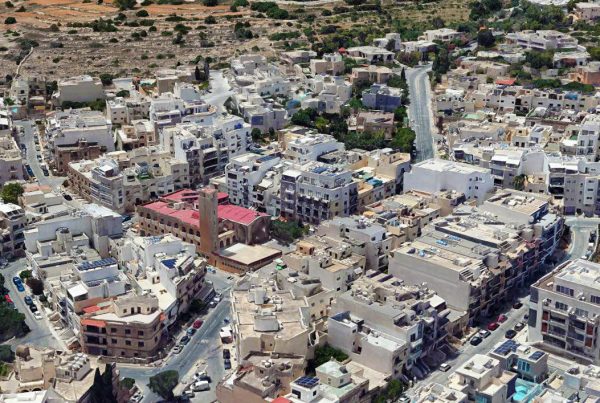

Demand remains firm, especially for properties between €201k–€350k, with growing interest in €500k+ listings—signaling appetite for higher-end real estate

Key investor segments include:

First-time buyers (though slightly decreasing),

Investors seeking rental or holiday properties,

Expatriates, who now make up over ¼ of the population and dominate rental demand (about 90% of tenants are non-Maltese)

Luxury and heritage homes (e.g., townhouses, villas, houses of character) are performing strongly, supported by redevelopment incentives and future capital appreciation potential

Rental Market (2024–2025)

1. Rental Price and Yield Trends

In H1 2024, average rents rose by 6.8% compared to H1 2023 Gross rental yields (pre-cost) vary by location:

Malta overall: ~4.05%

Mainland (1–3 beds): ~4.03%

Gozo: ~4.07%

St Julian’s: ~4.04% (highest among key areas)

St Paul’s Bay: ~3.63%

Sliema and Valletta are much lower: ~2.24% and ~1.72%, respectively

2. Trends and Market Characteristics

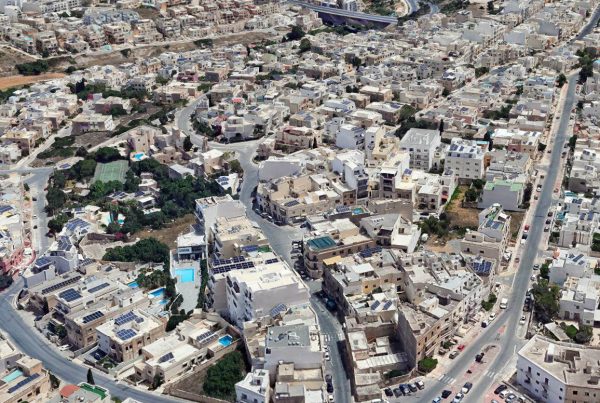

Sustainability and smart-home features are increasingly sought in rentals—eco-friendly upgrades (solar panels, efficient appliances) and tech amenities (smart locks, automated systems) are now expected and may boost rental value

Short-term rentals (e.g., Airbnb) remain lucrative, especially in Sliema, St Julian’s, and Gzira, thanks to tourism—they can yield gross returns of 5–7%

Rental demand continues strong from expats, students, and tourists. Vacancy remains low and yield steady in central areas

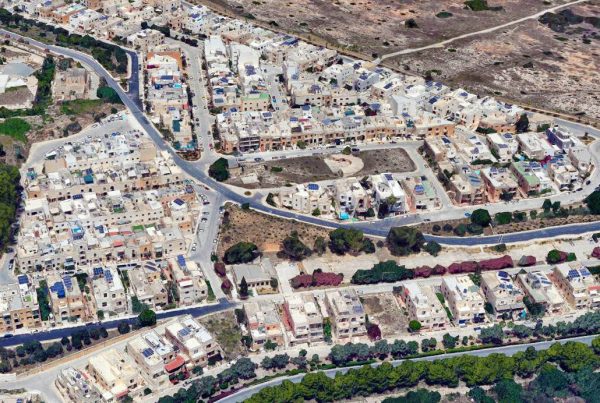

Some areas exhibit signs of oversupply (e.g., St Paul’s Bay, Mellieha), which may moderate rental price growth or ease upward pressure