如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

Malta’s First Jewish Centre, Including Synagogue And Kosher Restaurant, To Open In Heart Of Sliema.

‘The Jewish History of Magnificent Malta’ is the product of a collaboration between the Malta Tourism Authority and JLTV. ]

Over the last 10 years, Chabad of Malta in collaboration with the local Jewish community has become a dynamic force and a thriving center of light for the Jewish community and for thousands of Jewish tourists every year. They have been able to build a welcoming and warm space for every Jew. As they rapidly expand spiritually and physically, it is time for the community to build a permanent home.

Chabad of Malta focuses on the local Jewish community, education, and tourism. In addition to the Shabbat dinners, holiday celebrations, classes, kosher food, teen programs, and summer camp that is offered at Chabad, our center is a constant physical, emotional, and spiritual support in the lives of every Jew.

As the community grows at exponential rates, so do our necessities. Today, after thousands of years of Jewish existence on the island of Malta, Chabad together with the local Jewish community is proud to announce the building of the first-ever Jewish Center!

The Jewish center will be the heart for Jewish life in Malta. The center will be a hub of Jewish education, kosher food, and will have a beautiful synagogue. It will have a visitor center to introduce Jewish history and culture to Jews and non-Jews alike.

Today, your generous donation will go directly towards building the first Jewish Center in Malta history!

Whether you are a local, a past or future tourist, or someone who cares about the longevity of the Jewish community in Malta, your gift will help to continue growing and will expand the reach so that every Jew has a spiritual home in Malta!

HELP TO BUILD THE FIRST JEWISH CENTER IN MALTA

More Information about the Jewish center.

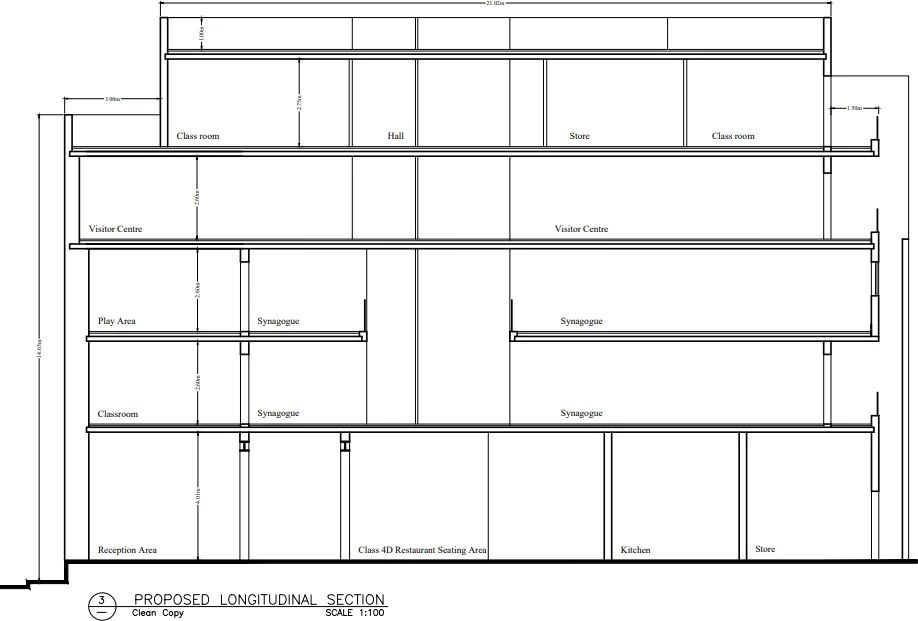

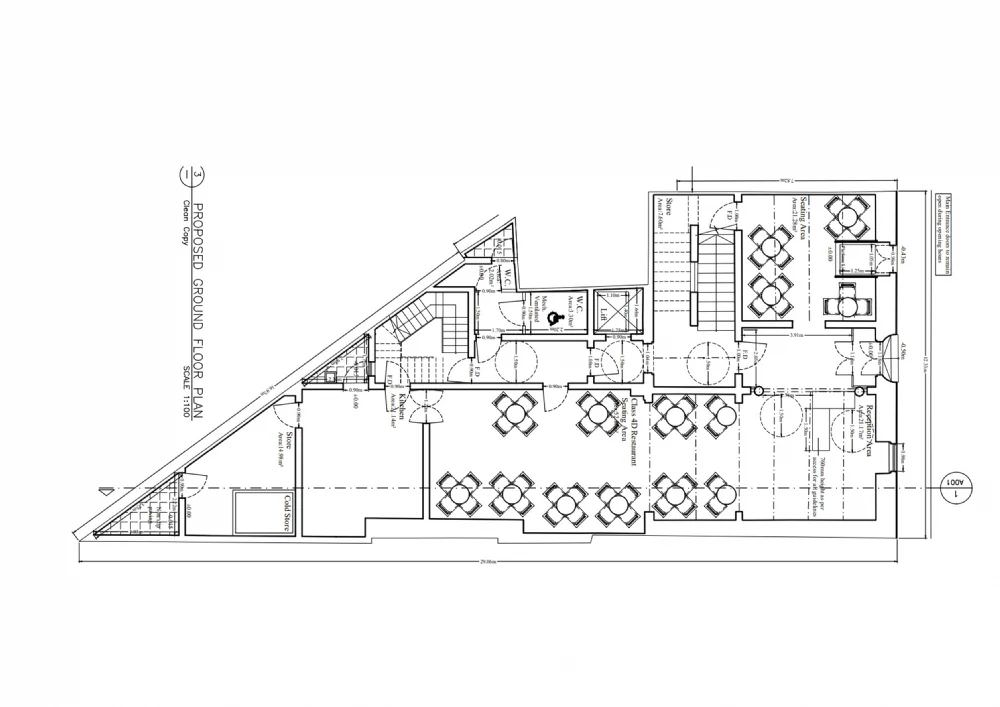

The former post office building located on Manoel Dimech Street in Sliema, situated opposite the police station, has been designated for the development of a synagogue, a restaurant, and classrooms for religious instruction.

According to the Chabad Malta Foundation, this project marks the “first Jewish center on the island of Malta in over 2,000 years of Jewish presence in Maltese history.”

The proposed Jewish center aims to serve both the local community and visiting tourists, featuring a kosher restaurant on the ground floor.

The project entails the partial demolition of the existing building while preserving and restoring its facade, constructing additional rooms at the rear of the property, and adding two new floors.

The new building is planned to match the height of the neighboring residential blocks on its left side.

The planning application was submitted by Rabbi Chaim on behalf of the Chabad Malta Foundation Segal.

Presently, Malta hosts two inconspicuous synagogues, situated in regular residential buildings in St Julian’s and Ta’ Xbiex.

Although Malta’s Jewish Community comprises only 250 members, the actual number may be higher, especially considering migrant communities and the influx of tourists and businessmen to the increasingly cosmopolitan island.

Historical Background:

Malta boasts a rich Jewish history dating back to antiquity. Rabbi Abraham Shmuel Abulafia, a renowned Jewish scholar and mystic, spent his final years in Comino approximately 750 years ago, where he authored two of his 50 books.

In 2003, the presumed remains of Abulafia and other Maltese Jews from the 1st Century were symbolically reburied in the Jewish Cemetery in Marsa.

Historical records from 1245 mention 25 Jewish families residing in Malta and eight in Gozo. During medieval times, Mdina designated a street along the north side of the cathedral as the Jewish quarter. However, the Edict of Expulsion in 1492 forced all Jews to leave Spanish territories, including Malta.

Under the Knights of St John, the Jewish population primarily consisted of slaves captured in piracy raids, as Jews found refuge in Ottoman lands following persecution and expulsion from Spanish territories.

In 1749, a Jewish slave named Giuseppe Antonio Cohen, who had been baptized, revealed a plot for a Muslim slave revolt, leading to his commendation and a pension from the authorities.

The modern Maltese Jewish community largely traces its roots to Jewish immigration during British rule from the United Kingdom, the Maghreb, and Turkey.

During the 1930s, Malta welcomed Jewish refugees fleeing Nazi persecution in Italy and Central Europe.

The Maltese Jewish community faced a setback when their synagogue in Spur Street was demolished in 1979 as part of a slum clearance and road widening project.

The community remained without a synagogue until 1984 when a new synagogue was inaugurated on Strada San Ursola. However, it collapsed in 1995 due to adjacent construction work undermining its foundations.

In 2000, a flat in Ta’ Xbiex was converted into a Jewish Center and Synagogue with contributions from the United States and the United Kingdom.

Press Links

Preserving Jewish heritage in Malta

Source TVM : October 31, 2021 : News, Video

History of the Jews in Malta

Source : Wikipedia : Article.

The Hidden Gem: Discovering the Jewish Heritage of Malta and its History

Source : New York Jewish Travel Guide : Article.

Jewish Families of Malta

Source : Geni world’s largest family tree : Study.

Applicability of the MLI

Malta and Israel have both signed the Multilateral Instrument (MLI), facilitating the automatic exchange of information between the two countries. Malta signed the MLI in 2017 and ratified it in 2018, while Israel signed it in 2017 and ratified it in 2019.

Residency for Tax Purposes in Malta

Residence of an Individual

An individual is considered a tax resident of Malta if they spend more than 183 days in Malta during a calendar year, whether these days are consecutive or cumulative. Additionally, an individual can be deemed a tax resident if they have a permanent home available to them in Malta, regardless of the number of days spent in the country. Even if the physical presence or permanent home criteria are not met, strong economic ties to Malta—such as employment, business activities, or investments—can establish tax residency. Another factor is the center of vital interests; if an individual’s personal and economic ties are predominantly in Malta, they are more likely to be considered a tax resident. For further details on individual tax residency and requirements, click here.

Residence of a Company

A company is considered a tax resident of Malta if it is incorporated and registered there, existing as a legal entity in Malta. If the central management and control of the company are exercised in Malta, the company is likely to be recognized as a tax resident. The composition of the board of directors is crucial; at least half of the directors must reside in Malta. To support a claim of tax residency, a company must maintain proper documentation and demonstrate a sufficient presence in Malta, including having an office space, employing local staff, and conducting substantial business activities within the country.

[Source: y-tax.co.il]

Relocation

Malta offers several tax benefits for individuals and businesses, making it an attractive destination for relocation. Here are some of the key tax advantages:

Individuals

Individuals interested in residency in Malta have several options:

1. Malta Residence and Visa Program (MRVP): Also known as the “Malta Golden Visa,” this program allows non-EU individuals and their families to reside, work, and study in Malta.

2. Malta Global Residence Program (GRP): This program enables non-EU individuals to acquire a residence permit by meeting specific requirements such as property investment or leasing.

3. Specialized Residency Programs: Malta offers programs tailored to different sectors, including the Malta Residence Program for High-Net-Worth Individuals (HNWIs) and the Malta Startup Visa Program for entrepreneurs.

The Global Residence Programme (GRP) is designed for individuals not currently residing in Malta but wishing to establish their residency there. This program allows eligible individuals to be taxed only on income derived from Malta and foreign income brought into Malta. Income from foreign sources not brought into Malta is not subject to taxation.

Real Estate Taxation in Malta

The real estate market in Malta is thriving and competitive, offering a diverse range of properties including historic homes, modern apartments, and luxury developments. Malta’s attractive location, Mediterranean climate, and strong economic growth continue to attract local and international buyers and investors.

Real estate taxation in Malta involves several components:

– Property Transfer Tax

– Stamp Duty

– Capital Gains Tax: Calculated based on the sale of property.

[Source: y-tax.co.il]