如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

Personal Loans | Low & Fixed Interest

Which banks offer home loans in Malta?

All major local banks offer home loans to property buyers in Malta, including:

- Link: BOV Home Loan

- Link: APS Home Loan

- Link: HSBC Home Loan

- Link: BNF Home Loan

- Link: Lombard Home Loan

- Link: Lidion Home Loan

- Link: ECCM Home Loan

- Link: Credorax Home Loan

- Link: Fimbank Home Loan

- Link: FCM Home Loan

- Link: IIG Home Loan

- Link: Izola Home Loan

- Link: Merkanti Home Loan

- Link: Medirect Home Loan

- Link: Novum Home Loan

- Link: Multitude Home Loan

- Link: GarantiBBVA Home Loan

- Link: Sparkasse Home Loan

- Link: AK Home Loan

Link to BOV Calculator : www.homeloan.bov.com/simple-calculator

Procedure for Obtaining a Home Loan in Malta

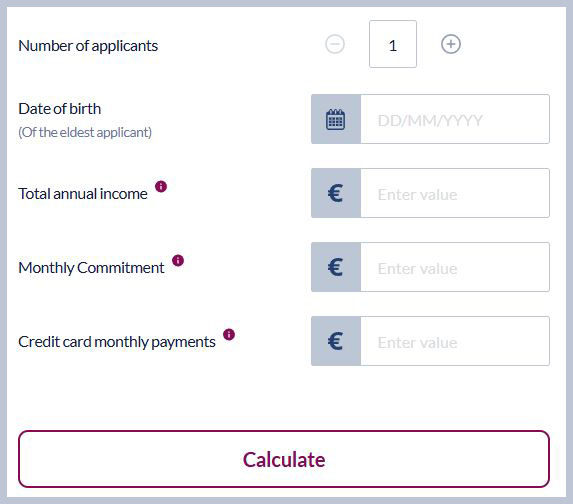

Before starting your property search in Malta, it’s a good idea to consult with your bank. Many buyers, especially first-time buyers, make the mistake of searching for a home before checking how much they can borrow based on their disposable income. This can lead to frustration when they find out that the bank will not lend them the full amount.

Once you know how much you can borrow, you can proceed with your loan application.

Home Loan Procedure

All banks in Malta follow a similar process when granting home loans. The mortgage offered depends on the condition of the property and its intended use. Residents can apply for loans that cover up to 90% of the purchase price, with repayment terms up to 40 years and low interest rates. If you’re purchasing with a partner, both of your incomes will be considered.

Home Loans for Non-Residents

Non-EU residents can typically borrow up to 80% of the property’s value, though this can vary. Monthly repayments should not exceed 30% of gross income, and the repayment period can extend up to 40 years, or until the age of 65.

Home Loan Conditions

Home loans generally come with the following terms:

- Loans covering up to 70-80% of the purchase price or completion costs

- Preferential interest rates, especially for the initial years or high-value loans

- Monthly repayments up to 30% of gross income

- Flexible repayment terms up to 40 years

Required Documentation

When applying for a home loan, banks typically request the following documentation:

- Latest payslips and FS3 (Annual Employee Statement of Earnings)

- Property value estimate by an architect or manager

- Character reference if you’re not already a bank customer

- Copy of ID card

- Copy of the preliminary agreement for the property purchase

Additionally, all banks offer bridging loan facilities and loans for purchasing summer residences. Some banks also provide special packages for first-time buyers or repeat buyers.

Property Loan for Maltese Citizens

Maltese citizens must provide the following documents:

- ID card or passport

- Proof of income (tax returns or FS3 forms)

- Documentation of existing financial obligations, such as unrelated loans or credit cards

- Documentation regarding life insurance policies, investments, assets, and bank statements from the last three years

- Property evaluation report from an architect, including plans, permits, and cost estimates

- The deed of acquisition or preliminary agreement

Property Loan for Non-Maltese Residents

The following documents are required for non-residents applying for a loan:

- Passport

- Proof of income (three income tax returns or three months’ payslips)

- Preliminary agreement or deed of acquisition

- Property evaluation report from an architect, including plans, permits, and cost estimates

- Bank reference

- Statements for any existing mortgages, loans, or credit accounts.

Malta's Real Estate Market and Financing Options

Malta’s real estate market is vast and varied, with properties available to meet a range of needs. When purchasing a property in Malta, various loan options are available, with competitive rates and tailored services offered by the main banks.

Financing a Property in Malta: Home Loan and Mortgage FAQ

How much can I borrow for a mortgage in Malta?

First-time buyers can borrow up to 90% of the property price. Monthly expenses, including the loan rate, cannot exceed 40% of monthly income. These restrictions do not apply for properties worth less than €175,000. Non-first-time buyers can borrow up to 85%.

What are the requirements for a mortgage in Malta?

To apply for a mortgage in Malta, you need an active Maltese bank account. Some banks also require life insurance.

How long is the mortgage payoff period?

First-time buyers must repay the loan within 40 years or by the time they reach retirement age, whichever comes first. Non-first-time buyers must repay the loan within 25 years or by retirement age, whichever comes first, and 25% of the loan amount must be repaid within the second year.