如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

如果您点击这里,此页面将被翻译成中文。

Who is eligible to purchase property in Malta?

The right to purchase property in Malta is regulated by the Acquisition of Immovable Property (AIP) Act. In line with the conservative stance of past legislators, a general provision prohibits non-residents from acquiring immovable property through any means that involves the transfer of real rights.

However, these restrictions have gradually relaxed over time to accommodate Malta’s transition into a nation increasingly hospitable to new ventures, a frontrunner in pivotal industries, and a growing haven for expatriates aiming to establish their personal and business interests in Malta.

The following passage aims to delineate the fundamental principles governing the property acquisition rights of both Maltese and non-Maltese individuals in Malta, shedding light on situations necessitating an AIP permit.

What is an AIP permit?

Non-residents seeking to purchase property in Malta need to obtain a permit under the Acquisition of Immovable Property Act (AIP Permit). This permit grants non-residents the ability to acquire property in Malta, contingent upon fulfilling certain conditions.

Maltese and EU citizens?

According to Maltese law, citizens of Malta and the European Union (EU) who have been residing in Malta for a minimum of 5 years before the acquisition have the right to purchase an unlimited number of properties.

However, this right does not extend to Maltese and EU citizens who have not lived in Malta for at least five years prior to the purchase. In such cases, Maltese law differentiates between primary and secondary residences; no restrictions apply if the property is intended to serve as the primary residence, where the purchaser resides for the majority of the time. However, if the property being acquired is intended as a secondary residence, such as for vacationing or secondary living purposes, an AIP permit is necessary.

Spouses of Maltese and EU citizens?

The regulations that apply to Maltese and EU citizens also extend to their spouses if both spouses are acquiring the property under the same deed. In such instances, the nationality or residency status of the spouse becomes irrelevant, and therefore, the necessity of an AIP permit or any other requirements would be determined based on the criteria applicable to Maltese/EU nationals.

Non-EU citizens

A non-resident is prohibited from acquiring immovable property in Malta unless the transaction adheres to the criteria specified in Maltese legislation.

For non-EU citizens aiming to buy property in Malta, obtaining an AIP permit is imperative, which is granted under either of the following conditions:

Minimum property value:

Villa or townhouse valued at €163,905

Apartment or maisonette valued at €98,370

If the property is in shell form or unconverted, finishing costs are factored into determining the property’s value.

The purchased property must be intended for one of the following purposes:

Solely for the personal residential use of the applicant

For other purposes sanctioned by the Government of Malta

For an endorsed industrial or touristic project

For any other project or purpose deemed to contribute to the development of the Maltese economy.

Trusts

Underlining the significant role trusts hold within the Maltese legal system, Maltese legislation also encompasses provisions for property acquisition through trusts. Pursuant to the AIP Act, trustees categorized as non-residents necessitate an AIP permit for property acquisition.

A trustee is classified as:

1:A non-resident individual unless all trust beneficiaries are identified and are residents of Malta.

2:A non-resident individual in the case of a discretionary trust, unless the power of appointment or any discretionary authority is exclusively vested in residents of Malta.

Conversely, a resident trustee is considered:

1:A non-resident of Malta if any of the beneficiaries are non-residents.

2:A non-resident individual in the case of a discretionary trust, where the power of appointment or any discretionary authority may benefit any non-resident individual.

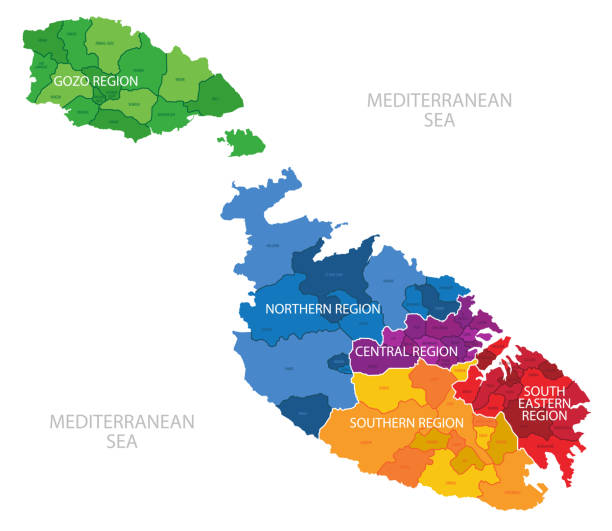

Property in Special Designated Areas

Non-Maltese buyers to acquire property with the same entitlements as Maltese citizens, thereby exempting them from obtaining a permit from the Maltese government. This exception holds particular significance for EU nationals who haven’t resided in Malta continuously for five years but intend to purchase a secondary residence.

In essence, this exemption means that buyers, regardless of their nationality, are not required to obtain an AIP permit.

The current Special Designated Areas include:

Portomaso Development, St. Julians, Malta

Portomaso Extension I, St Julians, Malta

Cottonera Development, Cottonera, Malta

Tigne Point, Tigne, Malta

Tas-Sellum Residence, Mellieha, Malta

Madliena Village Complex, Malta

SmartCity, Malta

Fort Cambridge Zone, Tignè, Malta

Ta’ Monita Residence, Marsascala, Malta

Pender Place, St. Julians, Malta

Metropolis Plaza, Gzira, Malta

Fort Chambray, Ghajnsielem, Gozo

Kempinski Residences, San Lawrenz, Gozo

Use of the property

The AIP Act stipulates that property obtained through an AIP permit must be utilized solely for the purpose specified in the permit. Consequently, individuals who procure property for primary residency purposes are prohibited from leasing out the property. Moreover, the requirement that the property serves as the primary residence means it cannot solely function as a holiday home. As an individual can only have one primary residence at any given time, acquiring property for primary residency implies the owner has relocated their center of activity to Malta, establishing legal residency for Income Tax purposes.

Likewise, companies obtaining property through an AIP permit must adhere to the designated purpose outlined in the permit.

In line with the principle that property acquired by non-residents in Special Designated Areas is obtained under the same conditions as residents, the aforementioned restrictions do not apply to properties acquired in these areas. Consequently, owners of property in Special Designated Areas can utilize the property as a secondary residence, holiday home, or lease it out to capitalize on the rental yields offered by these prime locations.

Malta’s Residency Schemes

Individuals who are not citizens of Malta have the opportunity to become residents of Malta through two primary schemes: the Ordinary Residence Scheme and the High Net Worth Individuals Scheme.

The Ordinary Residence Scheme caters to individuals seeking to establish physical residency in Malta and possess the financial means to sustain themselves adequately. Apart from benefiting from relatively low tax rates, European nationals becoming Ordinary Residents can engage in gainful employment and business activities in Malta.

Eligibility for the scheme requires applicants to maintain coverage under a local or international health insurance policy to avoid reliance on the local health and social security system. Successful applicants must then acquire or lease property to serve as their primary residence, thereby subjecting themselves to Malta’s competitive tax rates.

Under the tax system applicable to ordinary residents, taxation operates on a remittance basis. Consequently, ordinary residents are taxed solely on foreign source income remitted to Malta and on local source income. Thus, no tax liability arises on foreign source income not remitted to Malta and on foreign source capital gains, regardless of remittance.

Introduced in 2011, this scheme is open to EU and non-EU nationals meeting specific criteria who do not necessarily intend to spend extended periods in Malta but wish to leverage Malta’s competitive tax rates.

EU, EEA, or Swiss nationals seeking eligibility must demonstrate stable and regular financial resources. They must either purchase property valued at a minimum of €400,000 or lease property for a minimum of €20,000 annually, exclusively for their use and that of their family members. Additionally, applicants must possess health insurance and pass a fit and proper test, including an international due diligence exercise.

EU, EEA, or Swiss nationals must pay a minimum tax of €20,000, with an additional minimum tax of €2,500 per dependent to qualify.

Third-country nationals aiming to become long-term residents must furnish a financial bond of €500,000, along with an additional €150,000 per dependent, payable annually, to cover potential social costs. Fluency in one of Malta’s official languages, Maltese or English, is also required.

Third-country nationals already holding long-term residency in Malta are eligible to apply for this scheme as well, provided they meet the specified tax payment requirements.

For all applicants, including those holding High Net Worth status, compliance with property ownership, insurance, and financial stability requirements is essential. Maintaining non-Maltese domicile, residing in Malta for a minimum of 90 days annually, and refraining from staying in any other jurisdiction for more than 183 days, thus becoming a tax resident elsewhere, are also prerequisites.

Application for the Special Tax Status must be facilitated by an Authorized Registered Mandatory and incurs a fee of €6,000.